Grundläggande statistik

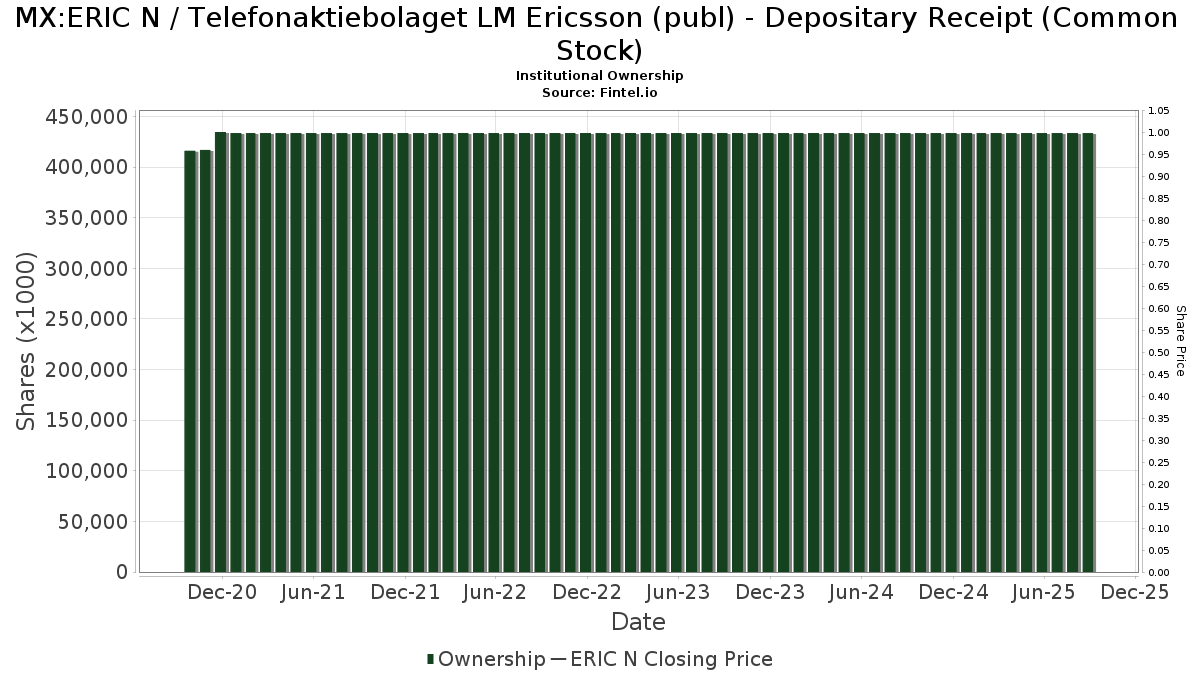

| Institutionella ägare | 443 total, 433 long only, 0 short only, 10 long/short - change of 15,99% MRQ |

| Genomsnittlig portföljallokering | 0.4074 % - change of 16,81% MRQ |

| Institutionella aktier (lång) | 491 476 382 (ex 13D/G) - change of 17,54MM shares 4,22% MRQ |

| Institutionellt värde (lång) | $ 3 380 146 USD ($1000) |

Institutionellt ägande och aktieägare

Telefonaktiebolaget LM Ericsson (publ) - Depositary Receipt (Common Stock) (MX:ERIC N) har 443 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 491,476,382 aktier. Största aktieägare inkluderar Hotchkis & Wiley Capital Management Llc, Acadian Asset Management Llc, VWNFX - Vanguard Windsor II Fund Investor Shares, Primecap Management Co/ca/, Renaissance Technologies Llc, VPMCX - Vanguard PRIMECAP Fund Investor Shares, Arrowstreet Capital, Limited Partnership, Morgan Stanley, UBS Group AG, and Optiver Holding B.V. .

Telefonaktiebolaget LM Ericsson (publ) - Depositary Receipt (Common Stock) (BMV:ERIC N) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-23 | 13F | Bear Mountain Capital, Inc. | 200 | 0,00 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 192 245 | 30,68 | 1 630 | 42,86 | ||||

| 2025-07-17 | 13F | Archford Capital Strategies, LLC | 143 502 | 1 217 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 28 482 | 95,04 | 238 | 110,62 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 14 760 | 125 | ||||||

| 2025-06-25 | NP | GENW - Genter Capital International Dividend ETF | 2 695 | 19,99 | 22 | 37,50 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 757 985 | −8,64 | 6 428 | −0,17 | ||||

| 2025-08-13 | 13F/A | StoneX Group Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Federated Hermes, Inc. | 3 096 | −12,54 | 26 | −3,70 | ||||

| 2025-05-02 | 13F/A | Mackenzie Financial Corp | 19 585 | 158 | ||||||

| 2025-07-22 | 13F | Checchi Capital Advisers, LLC | 15 443 | −10,88 | 131 | −2,99 | ||||

| 2025-06-30 | NP | PTIN - Pacer Trendpilot International ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Personal Cfo Solutions, Llc | 26 002 | 6,87 | 220 | 17,02 | ||||

| 2025-07-30 | 13F | Wallace Advisory Group, LLC | 11 034 | −1,51 | 86 | −5,56 | ||||

| 2025-08-11 | 13F | Dorsey Wright & Associates | 180 798 | −38,61 | 1 533 | −32,91 | ||||

| 2025-07-29 | NP | WEUSX - Siit World Equity Ex-us Fund - Class A | 3 556 980 | −0,31 | 30 092 | 2,36 | ||||

| 2025-08-12 | 13F | Foster Dykema Cabot & Partners, Llc | 6 552 | 0,00 | 56 | 7,84 | ||||

| 2025-05-01 | 13F | Schechter Investment Advisors, LLC | 18 476 | 9,54 | 143 | 5,93 | ||||

| 2025-07-30 | NP | ENDW - Cambria Endowment Style ETF | 51 | 0 | ||||||

| 2025-06-27 | NP | ZABDFX - American Beacon Diversified Fund AAL Class | 286 240 | −11,75 | 2 359 | −2,92 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1 282 032 | 229,27 | 10 872 | 259,85 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 60 | 0,00 | 1 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 8 526 | −12,74 | 72 | −4,00 | ||||

| 2025-07-07 | 13F | Hedges Asset Management LLC | 18 000 | 0,00 | 153 | 9,35 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 53 474 | −38,94 | 453 | −33,28 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 36 199 | 876,50 | 307 | 992,86 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 279 043 | −39,01 | 2 366 | −33,35 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 79 819 | 5,71 | 677 | 15,56 | ||||

| 2025-08-14 | 13F | Fmr Llc | 3 217 109 | 12,68 | 27 281 | 23,14 | ||||

| 2025-08-22 | NP | FENI - Fidelity Enhanced International ETF | 227 620 | 277,24 | 1 930 | 312,39 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 14 133 | 23,09 | 120 | 33,71 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 449 153 | −46,33 | 4 | −50,00 | ||||

| 2025-05-14 | 13F | Estabrook Capital Management | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Capital Fund Management S.a. | 924 442 | 29,92 | 7 839 | 41,99 | ||||

| 2025-08-20 | NP | NATIONWIDE VARIABLE INSURANCE TRUST - NVIT International Equity Fund Class I | 21 334 | 181 | ||||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 95 858 | −0,44 | 1 | |||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Internet Fund Variable Annuity | 5 316 | −9,50 | 45 | 0,00 | ||||

| 2025-07-18 | 13F | Institute for Wealth Management, LLC. | 60 275 | 0,00 | 511 | 9,42 | ||||

| 2025-08-20 | NP | HWCIX - Hotchkis & Wiley Diversified Value Fund Class I | 276 150 | −14,31 | 2 342 | −6,36 | ||||

| 2025-07-29 | 13F | Beverly Hills Private Wealth, LLC | 21 932 | −4,58 | 186 | 3,93 | ||||

| 2025-07-29 | 13F | Salomon & Ludwin, LLC | 33 | 135,71 | 0 | |||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 2 261 | 2 412,22 | 19 | |||||

| 2025-07-16 | 13F | Five Oceans Advisors | 21 739 | 0,00 | 184 | 9,52 | ||||

| 2025-07-24 | NP | ONEQ - Fidelity Nasdaq Composite Index Tracking Stock This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 65 109 | −43,17 | 551 | −41,74 | ||||

| 2025-07-31 | 13F | Whipplewood Advisors, LLC | 175 | 130,26 | 1 | 0,00 | ||||

| 2025-08-08 | 13F | Creative Planning | 23 295 | −25,45 | 198 | −18,60 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 22 210 | −29,57 | 188 | −24,50 | ||||

| 2025-08-26 | NP | Profunds - Profund Vp Europe 30 | 52 802 | 2,99 | 448 | 12,59 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 15 873 | −84,85 | 135 | −83,52 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 2 756 | 0,00 | 23 | 9,52 | ||||

| 2025-08-29 | 13F | Total Investment Management Inc | 1 | 0 | ||||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 107 411 | 911 | ||||||

| 2025-06-27 | NP | HAOSX - Harbor Overseas Fund Institutional Class | 541 270 | 11,16 | 4 460 | 22,29 | ||||

| 2025-07-28 | 13F | RFG Advisory, LLC | 16 927 | −0,32 | 144 | 9,16 | ||||

| 2025-08-06 | 13F | Penserra Capital Management LLC | 1 231 869 | 10 | ||||||

| 2025-06-26 | NP | HTECX - Hennessy Technology Fund Investor Class | 13 622 | −41,04 | 112 | −2,61 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 26 050 | 18,48 | 221 | 29,41 | ||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 399 | 3 | ||||||

| 2025-05-14 | 13F | Credit Agricole S A | 3 000 | 0,00 | 23 | −4,17 | ||||

| 2025-08-25 | NP | TDIV - First Trust NASDAQ Technology Dividend Index Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 750 073 | 2,47 | 6 361 | 11,97 | ||||

| 2025-08-01 | 13F | Ashton Thomas Private Wealth, LLC | 213 455 | 12,51 | 1 810 | 20,75 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 20 485 | 57,18 | 174 | 71,29 | ||||

| 2025-08-12 | 13F | Wayfinding Financial, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | EntryPoint Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 82 587 | −11,00 | 700 | −2,78 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 8 048 918 | 298,65 | 68 255 | 337,08 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | Put | 757 200 | 35,97 | 6 421 | 49,08 | |||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 24 371 | −11,98 | 207 | −3,74 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | Call | 576 900 | 103,64 | 4 892 | 123,28 | |||

| 2025-08-13 | 13F | Quantbot Technologies LP | 247 903 | 2 102 | ||||||

| 2025-08-12 | 13F | MAI Capital Management | 643 | 3 115,00 | 5 | |||||

| 2025-08-07 | 13F | Retirement Solution Inc. | 14 057 | 0,00 | 119 | 9,17 | ||||

| 2025-08-13 | 13F | Employees Retirement System of Texas | 0 | −100,00 | 0 | |||||

| 2025-06-30 | NP | VWNFX - Vanguard Windsor II Fund Investor Shares | 49 576 280 | −11,52 | 408 509 | −2,66 | ||||

| 2025-07-31 | 13F | Moser Wealth Advisors, LLC | 1 500 | 0,00 | 13 | 9,09 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 21 545 | 31,40 | 183 | 43,31 | ||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 1 376 301 | −15,51 | 11 671 | −7,67 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 23 511 | 199 | ||||||

| 2025-07-11 | 13F | Diversified Trust Co | 338 477 | −1,60 | 2 870 | 7,53 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 139 272 | −0,50 | 1 181 | 8,75 | ||||

| 2025-06-26 | NP | DFIC - Dimensional International Core Equity 2 ETF | 4 325 | 36 | ||||||

| 2025-08-08 | 13F | Gts Securities Llc | 142 821 | 58,46 | 1 211 | 73,25 | ||||

| 2025-07-25 | 13F | Concord Wealth Partners | 20 | 0,00 | 0 | |||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 134 | 0,00 | 1 | 0,00 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 19 954 | −66,95 | 169 | −63,89 | ||||

| 2025-07-24 | 13F | Callan Family Office, LLC | 107 750 | 210,02 | 914 | 239,41 | ||||

| 2025-06-23 | NP | UEPIX - Europe 30 Profund Investor Class | 9 426 | 74,07 | 78 | 92,50 | ||||

| 2025-08-08 | 13F | D'Orazio & Associates, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Vermillion Wealth Management, Inc. | 1 520 | −11,63 | 13 | −7,69 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 3 955 281 | 475,78 | 33 541 | 529,27 | ||||

| 2025-08-13 | 13F | Grantham, Mayo, Van Otterloo & Co. LLC | 37 929 | 322 | ||||||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 2 603 | 0,00 | 22 | 10,00 | ||||

| 2025-08-01 | 13F | Boyd Watterson Asset Management Llc/oh | 1 767 | 0,00 | 15 | 7,69 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 18 152 | −3,97 | 154 | 4,79 | ||||

| 2025-05-09 | 13F | Delta Asset Management Llc/tn | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | VANGUARD VARIABLE INSURANCE FUNDS - Diversified Value Portfolio This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 780 205 | −12,62 | 15 096 | −4,51 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 48 442 | 0 | ||||||

| 2025-08-14 | 13F | Bnp Paribas | 30 000 | 0,00 | 254 | 9,48 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 136 068 | −17,37 | 1 154 | −9,71 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 11 452 | −12,42 | 97 | −3,96 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 775 373 | 40,42 | 6 575 | 53,44 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 894 | 0,00 | 8 | 16,67 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 10 975 | 28,03 | 93 | 40,91 | ||||

| 2025-07-31 | 13F | R Squared Ltd | 11 480 | 97 | ||||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 575 000 | 1 050,00 | 5 | |||||

| 2025-08-04 | 13F | Atria Investments Llc | 52 846 | −0,56 | 448 | 8,74 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 322 558 | 2 735 | ||||||

| 2025-08-01 | 13F | Shilanski & Associates, Inc. | 28 798 | −0,44 | 244 | 8,93 | ||||

| 2025-06-26 | NP | Dfa Investment Trust Co - The Dfa International Value Series This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 208 667 | 0,00 | 1 719 | 10,05 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 291 779 | 46,31 | 2 474 | 59,92 | ||||

| 2025-06-27 | NP | PCLVX - PACE Large Co Value Equity Investments Class P | 527 561 | −19,34 | 4 347 | −11,25 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 15 975 909 | −48,77 | 135 476 | −44,01 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 67 | 0,00 | 1 | |||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 1 029 | 9 | ||||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 10 624 | 90 | ||||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 4 198 406 | −11,42 | 36 | −2,78 | ||||

| 2025-07-25 | NP | CMIEX - Multi-Manager International Equity Strategies Fund Institutional Class | 685 421 | 0,00 | 5 799 | 2,67 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 28 743 | 55,57 | 244 | 69,93 | ||||

| 2025-08-13 | 13F | M&t Bank Corp | 11 141 | 0,00 | 94 | 9,30 | ||||

| 2025-07-09 | 13F | Bruce G. Allen Investments, LLC | 239 | 2 | ||||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 269 333 | 104,27 | 2 284 | 123,17 | ||||

| 2025-08-27 | NP | RYIIX - Internet Fund Investor Class | 16 570 | 7,03 | 141 | 16,67 | ||||

| 2025-07-31 | 13F | Azzad Asset Management Inc /adv | 319 296 | −8,59 | 2 708 | −0,11 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 250 389 | 0,67 | 2 123 | 10,00 | ||||

| 2025-08-12 | 13F/A | Boston Partners | 173 430 | −9,22 | 1 471 | −0,81 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 12 135 | 103 | ||||||

| 2025-08-29 | NP | GCPAX - Gateway Equity Call Premium Fund Class A | 29 041 | 0,00 | 246 | 9,33 | ||||

| 2025-08-14 | 13F | UBS Group AG | 9 652 286 | 45,49 | 81 851 | 58,99 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 11 576 | 38,52 | 98 | 49,23 | ||||

| 2025-08-14 | 13F | UBS Group AG | Put | 23 000 | 195 | |||||

| 2025-07-18 | 13F | Truist Financial Corp | 35 325 | −8,63 | 300 | −0,33 | ||||

| 2025-08-04 | 13F/A | 626 Financial, LLC | 11 460 | 0,00 | 97 | 10,23 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 68 377 | 20,68 | 580 | 31,89 | ||||

| 2025-08-04 | 13F | AdvisorShares Investments LLC | 122 151 | 17,57 | 1 036 | 27,94 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | WIREX - Wireless Fund | 11 540 | 0,00 | 98 | 8,99 | ||||

| 2025-07-10 | 13F | NorthCrest Asset Manangement, LLC | 79 179 | −3,44 | 676 | 6,29 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 3 117 281 | 20,44 | 26 435 | 31,62 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 5 007 077 | −0,28 | 42 460 | 8,97 | ||||

| 2025-08-14 | 13F | Henry James International Management Inc. | 291 016 | 0,00 | 2 468 | 9,26 | ||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 883 | 68,19 | 7 | 75,00 | ||||

| 2025-08-13 | 13F | Diametric Capital, LP | 10 561 | 90 | ||||||

| 2025-05-15 | 13F | Wolverine Trading, Llc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-29 | NP | BPLSX - Boston Partners Long/Short Equity Fund INSTITUTIONAL | 92 358 | 2,29 | 781 | 5,11 | ||||

| 2025-07-15 | 13F | Td Private Client Wealth Llc | 40 774 | 40,27 | 346 | 53,33 | ||||

| 2025-05-14 | 13F | Walleye Capital LLC | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 1 361 | 10 | ||||||

| 2025-08-13 | 13F | Northern Trust Corp | 1 837 949 | −49,78 | 15 586 | −45,12 | ||||

| 2025-08-01 | 13F | MorganRosel Wealth Management, LLC | 200 | 0,00 | 2 | 0,00 | ||||

| 2025-04-30 | 13F | Valeo Financial Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-21 | NP | IEQ - Lazard International Dynamic Equity ETF | 8 238 | 70 | ||||||

| 2025-08-21 | NP | MNCSX - Mercer Non-US Core Equity Fund Class I | 250 056 | 0,00 | 2 120 | 9,28 | ||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 613 | −95,08 | 5 | −94,79 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 1 242 381 | 197,15 | 11 | 233,33 | ||||

| 2025-07-25 | 13F | CBOE Vest Financial, LLC | 23 082 | 21,35 | 196 | 32,65 | ||||

| 2025-08-11 | 13F | United Capital Financial Advisers, Llc | 31 136 | −8,54 | 264 | 0,00 | ||||

| 2025-07-22 | NP | DSHFX - Destinations Shelter Fund Class I | 13 618 | 0,00 | 115 | 2,68 | ||||

| 2025-08-06 | 13F | Hallmark Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 2 258 600 | 0,96 | 19 153 | 10,33 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 168 138 | 1 426 | ||||||

| 2025-06-25 | NP | IIGIX - Voya Multi-Manager International Equity Fund Class I | 155 892 | 1 285 | ||||||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 42 021 | 24,84 | 320 | 14,34 | ||||

| 2025-07-16 | 13F | West Branch Capital LLC | 100 | 0,00 | 1 | |||||

| 2025-08-06 | 13F | Csenge Advisory Group | 16 284 | −9,91 | 138 | −6,80 | ||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 2 000 | 0,00 | 17 | 6,67 | ||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 1 853 806 | 15 720 | ||||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 24 888 | −73,60 | 211 | −71,14 | ||||

| 2025-08-07 | 13F | Profund Advisors Llc | 61 046 | 3,58 | 518 | 13,13 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 1 606 | 0,00 | 14 | 8,33 | ||||

| 2025-07-25 | 13F | Hemington Wealth Management | 527 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | Cornerstone Planning Group LLC | 274 | 37,69 | 2 | 100,00 | ||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 71 189 | 1 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 7 769 | −7,92 | 0 | |||||

| 2025-04-29 | NP | EBI - Longview Advantage ETF | 1 520 | 13 | ||||||

| 2025-08-13 | 13F | Amundi | 498 887 | 0,00 | 4 260 | 14,18 | ||||

| 2025-08-14 | 13F | Atom Investors LP | 13 207 | 112 | ||||||

| 2025-07-14 | 13F | Legacy Capital Group California, Inc. | 34 674 | 20,49 | 294 | 31,84 | ||||

| 2025-07-10 | 13F | Contravisory Investment Management, Inc. | 29 046 | 6,97 | 246 | 17,14 | ||||

| 2025-08-27 | NP | RYMIX - Telecommunications Fund Investor Class | 18 893 | −69,15 | 160 | −66,32 | ||||

| 2025-07-30 | 13F | Denali Advisors Llc | 458 698 | 0,07 | 3 890 | 9,33 | ||||

| 2025-04-29 | 13F | Callan Capital, LLC | 71 962 | 27,04 | 558 | 22,37 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 494 | −4,11 | 13 | 0,00 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 133 436 | 30,60 | 1 132 | 42,80 | ||||

| 2025-07-28 | NP | AVIV - Avantis International Large Cap Value ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 172 795 | 12,32 | 1 462 | 15,31 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 328 478 | 16,48 | 2 785 | 27,29 | ||||

| 2025-08-12 | 13F | Dynamic Technology Lab Private Ltd | 25 957 | 60,09 | 220 | 74,60 | ||||

| 2025-07-15 | 13F | Mather Group, Llc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 106 | −96,78 | 1 | −100,00 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | Investors Research Corp | 44 683 | 0,00 | 379 | 9,25 | ||||

| 2025-05-13 | NP | SA FUNDS INVESTMENT TRUST - SA International Value Fund | 11 013 | 0,00 | 85 | −3,41 | ||||

| 2025-07-31 | 13F | CVA Family Office, LLC | 473 | 0,00 | 4 | 33,33 | ||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Baldwin Brothers Inc/ma | 35 673 | 22,18 | 303 | 33,63 | ||||

| 2025-07-18 | 13F/A | MJT & Associates Financial Advisory Group, Inc. | 1 994 | 0,00 | 17 | 6,67 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 137 | 1 | ||||||

| 2025-07-10 | 13F | Fulton Bank, N.a. | 24 316 | 61,62 | 206 | 77,59 | ||||

| 2025-07-28 | 13F | Bayforest Capital Ltd | 102 112 | −15,03 | 866 | −7,19 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 106 | −75,74 | 1 | −100,00 | ||||

| 2025-07-25 | 13F | Endowment Wealth Management, Inc. | 10 836 | 92 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 1 275 046 | 25,03 | 10 812 | 36,64 | ||||

| 2025-08-11 | 13F | Dorsey & Whitney Trust CO LLC | 40 514 | −3,11 | 344 | 5,86 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 32 769 | −31,86 | 0 | |||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 414 131 | 3 512 | ||||||

| 2025-07-24 | 13F | Brucke Financial, Inc. | 32 128 | 3,85 | 272 | 7,09 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 845 176 | 27,14 | 7 167 | 38,95 | ||||

| 2025-04-14 | 13F | Cetera Trust Company, N.A | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-11 | 13F | Integrated Quantitative Investments LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 3 524 928 | 590,89 | 29 891 | 655,01 | ||||

| 2025-08-27 | NP | VPCCX - Vanguard PRIMECAP Core Fund Investor Shares | 2 188 710 | −39,93 | 18 560 | −34,36 | ||||

| 2025-08-14 | 13F | Alliance Wealth Advisors, LLC /UT | 12 354 | 1,26 | 105 | 10,64 | ||||

| 2025-07-16 | 13F | Kathmere Capital Management, LLC | 32 024 | 16,50 | 272 | 27,23 | ||||

| 2025-05-12 | 13F | FIL Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-16 | 13F | Highline Wealth Partners Llc | 54 | −27,03 | 0 | |||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 12 789 | 2,63 | 108 | 12,50 | ||||

| 2025-08-28 | NP | DTLVX - Large Company Value Portfolio Investment Class | 170 182 | −13,34 | 1 443 | −5,25 | ||||

| 2025-06-27 | NP | SPTE - SP Funds S&P Global Technology ETF | 33 169 | 11,27 | 273 | 22,42 | ||||

| 2025-08-14 | 13F | Diversify Wealth Management, Llc | 138 777 | 16,61 | 1 056 | 6,99 | ||||

| 2025-08-14 | 13F | Family Management Corp | 16 018 | 136 | ||||||

| 2025-07-23 | 13F | Bingham Private Wealth, Llc | 10 026 | 85 | ||||||

| 2025-08-08 | 13F | CFO4Life Group, LLC | 14 614 | 40,09 | 124 | 53,75 | ||||

| 2025-08-13 | 13F | Colony Capital, Inc. | 3 893 867 | −18,35 | 33 020 | −10,78 | ||||

| 2025-08-28 | NP | SEEIX - Sit International Equity Fund - Class I | 1 696 672 | −18,09 | 14 388 | −10,49 | ||||

| 2025-05-01 | 13F | Marks Group Wealth Management, Inc | 0 | −100,00 | 0 | |||||

| 2025-06-27 | NP | SPWO - SP Funds S&P World (ex-US) ETF | 10 092 | 35,17 | 83 | 50,91 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 69 175 | 35,11 | 587 | 47,61 | ||||

| 2025-08-27 | NP | Advanced Series Trust - Ast Hotchkis & Wiley Large-cap Value Portfolio | 1 030 842 | −13,25 | 8 742 | −5,21 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 21 832 | 36,11 | 185 | 49,19 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 8 708 | 602,82 | 0 | |||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 3 397 | 13,42 | 29 | 21,74 | ||||

| 2025-07-09 | 13F | Gateway Investment Advisers Llc | 57 275 | −90,30 | 486 | −89,42 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 328 | 0,61 | 3 | 0,00 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 21 575 900 | 63,73 | 182 964 | 78,92 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 28 063 | 148,06 | 238 | 175,58 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 10 000 | −69,70 | 85 | −67,19 | ||||

| 2025-08-14 | 13F | Farringdon Capital, Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | VPMCX - Vanguard PRIMECAP Fund Investor Shares | 17 794 469 | −44,65 | 150 897 | −39,52 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 886 356 | −4,71 | 7 516 | 4,13 | ||||

| 2025-08-14 | 13F | Principia Wealth Advisory, LLC | 54 | 0 | ||||||

| 2025-07-14 | 13F | LCM Capital Management Inc | 12 251 | −1,67 | 104 | 7,29 | ||||

| 2025-08-20 | NP | HWSM - Hotchkis & Wiley SMID Cap Diversified Value Fund | 2 544 | 300,00 | 22 | 425,00 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 111 940 | 950 | ||||||

| 2025-07-30 | 13F | Rnc Capital Management Llc | 58 360 | 13,74 | 495 | 24,12 | ||||

| 2025-08-05 | 13F | Claro Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Ethic Inc. | 247 959 | −9,71 | 2 093 | −2,20 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-07 | 13F | Zions Bancorporation, National Association /ut/ | 148 | −4,52 | 1 | 0,00 | ||||

| 2025-07-30 | 13F | Forum Financial Management, LP | 252 252 | −8,13 | 2 139 | 0,42 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 665 815 | 321,18 | 6 | 400,00 | ||||

| 2025-06-25 | NP | TDVI - FT Vest Technology Dividend Target Income ETF | 21 097 | 13,40 | 174 | 24,46 | ||||

| 2025-03-25 | NP | Neuberger Berman Next Generation Connectivity Fund Inc. | 1 493 033 | −12,33 | 11 183 | −43,05 | ||||

| 2025-07-24 | 13F | Mengis Capital Management, Inc. | 22 300 | 0,00 | 189 | 9,25 | ||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 525 338 | −32,02 | 4 455 | −25,72 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 226 882 | 68,20 | 1 924 | 83,32 | ||||

| 2025-08-08 | 13F | Abc Arbitrage Sa | 5 121 349 | 64,59 | 43 429 | 79,86 | ||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 158 223 | 9,09 | 1 250 | 6,93 | ||||

| 2025-07-17 | 13F | Sage Rhino Capital Llc | 11 575 | −1,00 | 98 | 8,89 | ||||

| 2025-07-11 | 13F | Grove Bank & Trust | 8 339 | −1,24 | 71 | 7,69 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 1 900 | 0,00 | 16 | 14,29 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 208 439 | −0,63 | 1 768 | 8,60 | ||||

| 2025-08-07 | 13F | Addison Advisors LLC | 127 | 0,00 | 1 | |||||

| 2025-08-13 | 13F | Mount Yale Investment Advisors, LLC | 105 892 | 78,32 | 898 | 95,00 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 18 752 | 159 | ||||||

| 2025-07-25 | 13F | JustInvest LLC | 241 211 | 35,85 | 2 045 | 48,51 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-06-27 | NP | AADEX - American Beacon Large Cap Value Fund Institutional Class | 3 749 290 | −19,69 | 30 894 | −11,65 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 73 | 1 | ||||||

| 2025-08-28 | NP | SMINX - SIMT Tax-Managed International Managed Volatility Fund Class F | 31 699 | −29,46 | 269 | −22,99 | ||||

| 2025-05-09 | 13F | Maxi Investments CY Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 25 295 | 0,25 | 216 | 10,26 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 56 595 | 3,94 | 439 | 0,23 | ||||

| 2025-07-28 | NP | AVDEX - Avantis International Equity Fund Institutional Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 43 604 | 0,00 | 369 | 2,51 | ||||

| 2025-07-30 | 13F | Legacy Wealth Asset Management, LLC | 90 934 | −11,47 | 771 | −3,26 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 34 882 | 57,26 | 296 | 71,51 | ||||

| 2025-08-27 | NP | FAIEX - PFM Multi-Manager International Equity Fund Institutional Class | 101 210 | 1,70 | 858 | 11,14 | ||||

| 2025-06-27 | NP | POSKX - PRIMECAP Odyssey Stock Fund | 4 471 530 | −0,96 | 36 845 | 8,96 | ||||

| 2025-07-15 | 13F | Burns Matteson Capital Management, LLC | 20 192 | 43,45 | 171 | 56,88 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 78 976 | −13,38 | 670 | −5,37 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 132 678 | 68,01 | 1 125 | 83,82 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 1 199 | 54,51 | 10 | 66,67 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Barclays Plc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 86 158 | 0,10 | 731 | 9,45 | ||||

| 2025-09-04 | 13F | Reynders McVeigh Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | DIHRX - International High Relative Profitability Portfolio Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 144 507 | 0,00 | 1 191 | 9,98 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 252 258 | −4,57 | 2 134 | −2,02 | ||||

| 2025-08-14 | 13F | ICONIQ Capital, LLC | 11 819 | −6,73 | 100 | 2,04 | ||||

| 2025-08-14 | 13F | DRW Securities, LLC | 15 454 | 131 | ||||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 64 755 | 14,42 | 549 | 25,06 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 132 301 | −44,57 | 1 122 | −39,47 | ||||

| 2025-08-26 | NP | EHLS - Even Herd Long Short ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Aprio Wealth Management, LLC | 19 946 | −57,86 | 169 | −53,95 | ||||

| 2025-05-13 | 13F | Hartland & Co., LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 94 199 | −15,17 | 799 | −7,32 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 4 569 | 13,63 | 39 | 22,58 | ||||

| 2025-08-13 | 13F | Manning & Napier Advisors Llc | 304 896 | 2 586 | ||||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 48 490 | 12,97 | 411 | 23,42 | ||||

| 2025-08-01 | 13F | Koss-Olinger Consulting, LLC | 11 442 | −20,77 | 97 | −13,39 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 3 350 029 | 42,88 | 28 408 | 56,14 | ||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 380 351 | 3 225 | ||||||

| 2025-08-27 | NP | OAIEX - Optimum International Fund Class A | 759 912 | −3,69 | 6 444 | 5,26 | ||||

| 2025-08-08 | 13F | Empower Advisory Group, LLC | 16 284 | −25,51 | 138 | −18,34 | ||||

| 2025-08-13 | 13F | Great Diamond Partners, LLC | 76 543 | 1,76 | 649 | 11,32 | ||||

| 2025-08-01 | 13F | SYM FINANCIAL Corp | 11 179 | 95 | ||||||

| 2025-07-11 | 13F | International Private Wealth Advisors LLC | 14 132 | 36,67 | 120 | 48,75 | ||||

| 2025-07-09 | 13F | Aaron Wealth Advisors LLC | 32 414 | 7,61 | 275 | 17,60 | ||||

| 2025-08-07 | 13F | Vise Technologies, Inc. | 92 886 | 54,50 | 788 | 62,60 | ||||

| 2025-07-31 | 13F | MQS Management LLC | 11 518 | 98 | ||||||

| 2025-07-25 | 13F | Yousif Capital Management, Llc | 55 228 | 16,96 | 468 | 27,87 | ||||

| 2025-06-27 | NP | POGRX - PRIMECAP Odyssey Growth Fund | 1 288 800 | −2,72 | 10 620 | 7,02 | ||||

| 2025-08-14 | 13F | XY Capital Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 38 596 | 8,40 | 327 | 18,48 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 106 673 | 19,33 | 905 | 30,45 | ||||

| 2025-08-01 | 13F | Oversea-Chinese Banking CORP Ltd | 63 653 | −14,03 | 540 | −6,10 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 826 494 | 20,57 | 7 009 | 31,75 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 23 672 | −13,96 | 201 | −6,10 | ||||

| 2025-08-06 | 13F | Mark Sheptoff Financial Planning, Llc | 3 500 | 0,00 | 30 | 7,41 | ||||

| 2025-08-11 | 13F | GW&K Investment Management, LLC | 524 | 0,00 | 0 | |||||

| 2025-08-26 | NP | GMOI - GMO International Value ETF | 37 929 | 322 | ||||||

| 2025-04-24 | 13F | Decker Retirement Planning Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 23 173 | 10,16 | 0 | |||||

| 2025-08-11 | 13F | Intrust Bank Na | 46 028 | −2,67 | 390 | 6,56 | ||||

| 2025-07-30 | NP | AIQ - Global X Future Analytics Tech ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 208 552 | −0,10 | 10 224 | 2,57 | ||||

| 2025-07-16 | 13F | Magnus Financial Group LLC | 10 605 | 90 | ||||||

| 2025-08-14 | 13F | Macquarie Group Ltd | 759 912 | −3,69 | 6 444 | 5,24 | ||||

| 2025-07-22 | 13F | Rocky Mountain Advisers, Llc | 150 | 0,00 | 1 | 0,00 | ||||

| 2025-05-08 | NP | QGBLX - Quantified Global Fund Investor Class | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-02 | 13F | Sachetta, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-28 | NP | HWSIX - Hotchkis & Wiley Small Cap Value Fund Class I | 79 200 | −83,67 | 615 | −84,29 | ||||

| 2025-07-31 | 13F | Moloney Securities Asset Management, LLC | 15 000 | −44,44 | 127 | −39,23 | ||||

| 2025-05-13 | 13F | Measured Risk Portfolios, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1 502 | 3 959,46 | 13 | |||||

| 2025-08-14 | 13F | Beaird Harris Wealth Management, LLC | 132 | 1 | ||||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 13 486 | 0,00 | 114 | 9,62 | ||||

| 2025-08-04 | 13F | Kovack Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 1 308 676 | 5,63 | 11 097 | 15,42 | ||||

| 2025-08-13 | 13F | Blueshift Asset Management, LLC | 46 511 | 394 | ||||||

| 2025-07-23 | 13F | Nbt Bank N A /ny | 437 | 0,00 | 4 | 0,00 | ||||

| 2025-06-26 | NP | DIHP - Dimensional International High Profitability ETF | 240 | 0,00 | 2 | 0,00 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 15 952 362 | 16,61 | 135 276 | 27,43 | ||||

| 2025-08-20 | NP | HWLIX - Hotchkis & Wiley Large Cap Value Fund Class I | 1 323 500 | −12,63 | 11 223 | −4,52 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 1 288 | 11 | ||||||

| 2025-04-23 | 13F | Mascagni Wealth Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | REAP Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 44 531 | −22,23 | 378 | −15,09 | ||||

| 2025-08-14 | 13F | Hotchkis & Wiley Capital Management Llc | 97 029 167 | −10,30 | 822 807 | −1,97 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 11 111 | 70,28 | 94 | 88,00 | ||||

| 2025-08-08 | 13F | Wrapmanager Inc | 11 034 | −30,57 | 94 | −24,39 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 75 | 733,33 | 1 | |||||

| 2025-08-13 | 13F | Jump Financial, LLC | 2 059 036 | 17 461 | ||||||

| 2025-08-14 | 13F | Syon Capital Llc | 194 745 | 65,95 | 1 651 | 81,43 | ||||

| 2025-08-15 | 13F | Earnest Partners Llc | 338 416 | −6,36 | 2 870 | 2,32 | ||||

| 2025-07-21 | 13F | Credential Securities Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 86 249 | −91,96 | 731 | −91,22 | ||||

| 2025-05-06 | 13F | Advisors Preferred, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Primecap Management Co/ca/ | 26 493 699 | −42,17 | 224 667 | −36,81 | ||||

| 2025-08-12 | 13F | Aigen Investment Management, Lp | 279 434 | 2 370 | ||||||

| 2025-08-26 | NP | Nuveen S&p 500 Buywrite Income Fund This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 95 165 | −46,40 | 807 | −41,47 | ||||

| 2025-07-24 | NP | FWRLX - Wireless Portfolio This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 209 600 | 0,00 | 1 773 | 2,66 | ||||

| 2025-07-09 | 13F | Sivia Capital Partners, LLC | 20 462 | 174 | ||||||

| 2025-08-06 | 13F | Vestmark Advisory Solutions, Inc. | 14 006 | 119 | ||||||

| 2025-07-29 | 13F | Private Trust Co Na | 3 646 | 34,04 | 31 | 42,86 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 76 200 | 10,43 | 1 | ||||

| 2025-08-12 | 13F | Minot DeBlois Advisors LLC | 4 350 | 0,00 | 37 | 9,09 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 93 962 | −8,08 | 797 | 0,38 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 275 311 | −4,93 | 2 335 | 3,87 | ||||

| 2025-07-30 | NP | FILFX - Strategic Advisers International Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 422 080 | 0,00 | 12 031 | 2,67 | ||||

| 2025-08-14 | 13F | Woodline Partners LP | 89 762 | 761 | ||||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 53 863 | 15,90 | 457 | 26,67 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 255 700 | 42,93 | 2 168 | 56,20 | |||

| 2025-08-13 | 13F | Truvestments Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 106 600 | −4,65 | 904 | 4,15 | |||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 3 365 879 | 28 543 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 156 300 | −47,18 | 1 | −50,00 | |||

| 2025-06-27 | NP | AADBX - American Beacon Balanced Fund Institutional Class | 109 130 | −14,16 | 899 | −5,57 | ||||

| 2025-08-01 | 13F | Bank of Jackson Hole Trust | 1 000 | 0,00 | 8 | 0,00 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 175 759 | −30,85 | 1 490 | −24,44 | ||||

| 2025-07-28 | NP | AVDE - Avantis International Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 689 492 | 10,92 | 5 833 | 13,88 | ||||

| 2025-07-30 | 13F | Financial Perspectives, Inc | 4 603 | 0,00 | 39 | 11,43 | ||||

| 2025-08-20 | NP | HWAIX - Hotchkis & Wiley Value Opportunities Fund Class I | 4 689 200 | −10,15 | 39 764 | −1,81 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Sustainability Core 1 Portfolio Shares | 51 015 | 0,00 | 420 | 9,95 | ||||

| 2025-07-30 | 13F | Caliber Wealth Management, LLC / KS | 14 235 | 0,00 | 121 | 9,09 | ||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 267 095 | −0,03 | 2 265 | 9,21 | ||||

| 2025-05-09 | 13F | Scotia Capital Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | BCS Private Wealth Management, Inc. | 297 098 | 3 | ||||||

| 2025-07-30 | 13F | Eqis Capital Management, Inc. | 11 526 | −22,46 | 98 | −15,65 | ||||

| 2025-07-30 | 13F | Cookson Peirce & Co Inc | 141 531 | 23,68 | 1 200 | 35,29 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 732 | −27,24 | 0 | |||||

| 2025-08-05 | 13F | Huntington National Bank | 963 | 48 050,00 | 8 | |||||

| 2025-07-28 | 13F | Naviter Wealth, LLC | 34 459 | 292 | ||||||

| 2025-08-12 | 13F | Trexquant Investment LP | 648 118 | −60,80 | 5 496 | −57,17 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 131 242 | 14,19 | 1 113 | 24,80 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 47 700 | −9,32 | 404 | −0,98 | |||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Call | 62 700 | −34,35 | 532 | −28,34 | |||

| 2025-07-30 | 13F | Crewe Advisors LLC | 100 | 1 | ||||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 81 043 144 | −7,18 | 687 | 1,48 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 7 232 | 126,28 | 61 | 134,62 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 4 232 | 0,00 | 36 | 2,94 | ||||

| 2025-08-14 | 13F | Bayesian Capital Management, LP | 343 400 | 2 912 | ||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 932 217 | 7,06 | 7 905 | 16,99 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 43 438 | −36,58 | 368 | −30,70 | ||||

| 2025-08-14 | 13F | Guardian Wealth Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-29 | NP | GATEX - Gateway Fund Class A Shares | 367 832 | −38,13 | 2 854 | −40,43 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 351 600 | −47,15 | 2 982 | −42,25 | |||

| 2025-07-17 | 13F | Michels Family Financial, LLC | 80 445 | −2,62 | 682 | 6,40 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 26 060 | 129,81 | 221 | 152,87 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 470 300 | −36,58 | 3 988 | −30,69 | |||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 735 478 | −0,21 | 6 237 | 8,98 | ||||

| 2025-07-21 | 13F | Ascent Group, LLC | 22 122 | 24,83 | 188 | 36,50 | ||||

| 2025-07-09 | 13F | Baron Wealth Management LLC | 11 516 | 5,08 | 98 | 14,12 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 4 051 458 | 37,28 | 34 356 | 50,01 | ||||

| 2025-08-06 | 13F | SOUTH STATE Corp | 910 | 0,00 | 8 | 0,00 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 17 927 | 61,56 | 153 | 77,91 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 815 783 | 3,54 | 6 918 | 13,13 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 13 217 | 1,80 | 112 | 12,00 | ||||

| 2025-07-28 | NP | AVSD - Avantis Responsible International Equity ETF | 30 853 | 0,00 | 261 | 2,76 | ||||

| 2025-08-27 | NP | VANGUARD VARIABLE INSURANCE FUNDS - Capital Growth Portfolio This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 478 900 | −55,89 | 4 061 | −51,80 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 6 988 533 | 45,33 | 59 263 | 58,82 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 2 075 092 | −23,25 | 17 597 | −16,13 | ||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 62 | −3,12 | 1 | |||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 14 216 | 0,33 | 110 | −3,51 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 23 763 | 47,79 | 202 | 62,10 | ||||

| 2025-07-25 | 13F | Ruedi Wealth Management, Inc. | 19 157 | 0,00 | 162 | 9,46 | ||||

| 2025-08-26 | NP | LCORX - Leuthold Core Investment Fund Retail Class | 378 070 | 49,22 | 3 206 | 63,07 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Peak6 Llc | Put | 50 000 | 0,00 | 424 | 9,28 | |||

| 2025-08-14 | 13F | Peak6 Llc | Call | 92 800 | 787 | |||||

| 2025-08-20 | NP | HWGIX - Hotchkis & Wiley Global Value Fund Class I | 161 672 | 0,00 | 1 371 | 9,25 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 212 582 | 125,81 | 1 803 | 146,85 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 799 | 0,00 | 7 | 0,00 | ||||

| 2025-05-02 | 13F | Cable Hill Partners, LLC | 31 254 | 1,40 | 258 | 3,63 | ||||

| 2025-07-28 | 13F | Private Wealth Asset Management, LLC | 96 | 0,00 | 1 | |||||

| 2025-08-13 | 13F | Leuthold Group, Llc | 602 678 | 49,12 | 5 111 | 62,95 | ||||

| 2025-05-16 | 13F/A | Kestra Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 2 769 026 | −12,98 | 23 373 | −5,59 | ||||

| 2025-06-26 | NP | SNTKX - Steward International Enhanced Index Fund Class A | 143 601 | 0,00 | 1 183 | 10,05 | ||||

| 2025-08-28 | NP | IDGT - iShares North American Tech-Multimedia Networking ETF | 595 758 | −16,28 | 5 052 | −8,49 | ||||

| 2025-08-11 | 13F | Lsv Asset Management | 34 300 | 0 | ||||||

| 2025-04-22 | 13F | Mendota Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Nilsine Partners, LLC | 18 664 | −7,00 | 158 | 1,94 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 8 425 | 67,86 | 71 | 82,05 | ||||

| 2025-05-12 | 13F | Waterloo Capital, L.P. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 15 100 | 0,99 | 128 | 10,34 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 173 | 45,38 | 1 | |||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 52 063 | 6,49 | 441 | 11,93 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 1 632 | 126,67 | 14 | 225,00 | ||||

| 2025-08-14 | 13F | Corient IA LLC | 11 000 | 93 | ||||||

| 2025-07-21 | 13F | Qrg Capital Management, Inc. | 505 096 | 2,22 | 4 283 | 11,71 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 37 711 | −9,22 | 320 | −0,93 | ||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 476 | 0,00 | 4 | 33,33 | ||||

| 2025-06-20 | NP | ABLG - TrimTabs All Cap International Free-Cash-Flow ETF | 120 158 | 835,74 | 990 | 1 446,88 | ||||

| 2025-08-20 | NP | HWMIX - Hotchkis & Wiley Mid-Cap Value Fund Class I | 1 756 800 | −3,74 | 14 898 | 5,19 | ||||

| 2025-08-13 | 13F | Natixis Advisors, L.p. | 899 106 | 6,09 | 8 | 16,67 | ||||

| 2025-08-14 | 13F | Turim 21 Investimentos Ltda. | 670 000 | 0,00 | 5 682 | 9,27 | ||||

| 2025-07-08 | 13F | Rise Advisors, LLC | 1 | 0,00 | 0 | |||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 430 741 | 15,26 | 3 653 | 25,97 | ||||

| 2025-08-19 | 13F/A | Pitcairn Co | 17 728 | −5,61 | 150 | 3,45 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 229 | 218,06 | 2 | |||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 10 | 0,00 | 0 | |||||

| 2025-07-10 | 13F | HF Advisory Group, LLC | 13 419 | 114 | ||||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 2 250 | 0,00 | 19 | 11,76 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 175 | −3,85 | 1 | 0,00 | ||||

| 2025-08-25 | NP | AADR - AdvisorShares Dorsey Wright ADR ETF | 122 151 | 17,57 | 1 036 | 28,41 | ||||

| 2025-05-12 | 13F | Financial Engines Advisors L.L.C. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 11 620 | −33,91 | 99 | −30,50 | ||||

| 2025-08-04 | 13F | Simon Quick Advisors, Llc | 12 227 | 104 | ||||||

| 2025-07-18 | 13F | Dogwood Wealth Management LLC | 592 | 5 | ||||||

| 2025-07-18 | 13F | PFG Investments, LLC | 10 078 | 85 | ||||||

| 2025-07-21 | 13F | Cromwell Holdings LLC | 10 276 | 72,82 | 87 | 89,13 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 79 858 | 677 | ||||||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 57 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | American Century Companies Inc | 988 708 | 13,76 | 8 384 | 24,32 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 67 141 | 94,12 | 569 | 112,31 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 31 223 | 107,39 | 265 | 127,59 | ||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 184 390 | 0,00 | 1 560 | 2,63 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 647 | −53,82 | 5 | −50,00 | ||||

| 2025-07-29 | NP | SSEAX - SIIT Screened World Equity Ex-US Fund - Class A | 80 029 | −19,29 | 677 | −17,14 | ||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 267 | −79,77 | 2 | −80,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 41 800 | 354 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 923 | 0,00 | 8 | 0,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 469 551 | −80,34 | 3 982 | −78,52 | ||||

| 2025-08-14 | 13F | Peak6 Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 4 796 | 41 | ||||||

| 2025-08-15 | 13F | WealthCollab, LLC | 942 | −57,72 | 8 | −58,82 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 43 999 | 189,85 | 373 | 218,80 | ||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 31 170 | −4,19 | 264 | 4,76 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 16 494 | 18,68 | 140 | 29,91 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 4 249 | 36 | ||||||

| 2025-04-11 | 13F | First Affirmative Financial Network | 38 453 | −4,30 | 298 | −7,74 | ||||

| 2025-07-25 | 13F | Stephens Consulting, LLC | 281 | 2 | ||||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 6 235 | 402,82 | 53 | 477,78 | ||||

| 2025-07-15 | 13F | Drum Hill Capital, LLC | 713 002 | −1,71 | 6 046 | 7,41 | ||||

| 2025-08-26 | NP | LST - Leuthold Select Industries ETF | 23 014 | 81,57 | 195 | 98,98 | ||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Telecommunications Fund Variable Annuity | 12 695 | 155,07 | 108 | 181,58 | ||||

| 2025-07-28 | 13F | Ritholtz Wealth Management | 303 538 | −5,94 | 2 574 | 2,80 | ||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 924 788 | 347,06 | 7 842 | 388,60 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 19 100 | 162 | |||||

| 2025-07-21 | 13F | Hennessy Advisors Inc | 13 622 | 116 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 39 458 | −27,34 | 335 | −20,43 | ||||

| 2025-08-22 | NP | SIXG - Defiance Next Gen Connectivity ETF | 1 231 869 | −1,94 | 10 446 | 7,17 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 3 089 572 | −17,42 | 26 200 | −9,76 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 11 300 | 39,51 | 96 | 53,23 | |||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 1 227 079 | −23,00 | 10 406 | −15,86 | ||||

| 2025-08-05 | 13F | Ellevest, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 20 800 | 4,00 | 176 | 13,55 | |||

| 2025-08-13 | 13F | Walleye Trading LLC | 14 424 | −51,61 | 122 | −47,19 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 2 300 | 475,00 | 20 | 533,33 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 141 000 | 365,35 | 1 196 | 408,51 |